Bike Rental Market Size And Forecast, By Product (Docked, Dockless), By Region (North America, Europe, Asia Pacific, Rest of the World) And Trend Analysis, 2019 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Automotive & Transportation

Industry Insights

The global bike rental market was valued at USD 1.37 billion in 2017 and is expected to grow at a CAGR of 14.3% from 2017 to 2025. The rising importance of greener transportation system as a result of the implementation of eco-friendly policies by regulatory bodies including, EPA and European Commission aimed to control pollution is expected to expand the scope of bike sharing services.

For instance, as per certain estimates, in 2016, bike sharing services helped reduce carbon dioxide emissions by more than 25,000 tons in Shanghai. Also, the growing awareness among consumers about the necessity to reduce carbon footprints coupled with the extensive promotional campaigns by service providers such as Mobi Bike and ofo are projected to promote the visibility of bike rental solutions.

Companies in the market are raising money through venture capital firms to set up stations and expand their bike sharing service to a larger consumer base. For instance, Lime raised USD 62.0 million from American basketball player Kevin Durant.

Vandalism and theft are among the challenges faced by the bike rental service providers. The issues are more prevalent for dockless service providers as rented bikes in this service model are collected and returned to the station from the places where they are left by the service providers themselves. To this end, service providers are exploring high-tech solutions including the installation of GPS trackers in bikes to combat the challenges of vandalism and theft.

Segmentation by Product Type

• Docked bikes

• Dockless bikes

Docked bike rental service dominated the market accounting for more than 77.0% share in 2017. Traditional docked services has boomed in the past seven to eight years. High penetration and supportive infrastructure in developed countries such as the U.S., France, and the UK are expected to remain favorable factors over the coming years. According to reports, around 120 cities across the docked bike service operators. Chicago, Denver, Minneapolis, Portland, and New York are among the few cities in the country which are actively covered by docked bike share service providers.

Dockless bike rental services are expected to grow at a CAGR of more than 19.0% from 2017 to 2025. The proliferation of internet of things (IoT), global positioning system (GPS), and mobile app-based payment system have eased locating, tracking, and payment activities, which in turn has led to the increased adoption of rental service.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Rest of the World

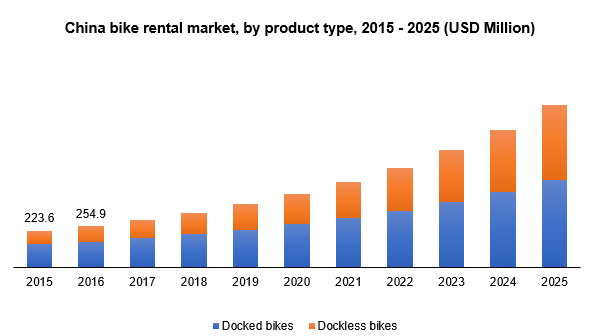

Asia Pacific was the largest market accounting for a share of more than 40.0% in 2017. China was the leading contributor in the Asia Pacific region and has witnessed several new market entrants since 2014. Investments in the market have enabled the operators to expand their business in China. For instance, in 2018, ofo raised USD 866 million in a funding round led by Alibaba.

Besides China, India presents a potential growth opportunity for the market. Penetration of the service has increased considerably in the country over the recent past. Companies are majorly focusing on targeting school and college students. For instance, in 2016, Ola launched Ola Pedal at the IIT Kanpur campus.

Europe was the second largest market behind Asia Pacific, accounting for more than 35.0% of the share in 2017. Increasing penetration of dockless rental service operators in countries such as Germany and the UK is expected to increase the growth potential of the market over the coming years.

Competitive Landscape

The global bike rental market is growing with companies having country-specific and international presence. Some of the service providers in the market include Mobi Bike, ofo, and Lyft. Player operating in the market are focusing on raising funds for expanding their presence.

In addition, large service providers including Uber and Lyft are entering into mergers & acquisitions to expand geographical reach. For instance, Lyft acquired Citi bike, one of the leading service providers in the U.S. to enter the country.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service